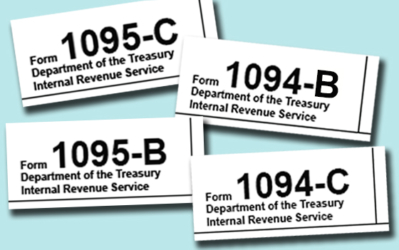

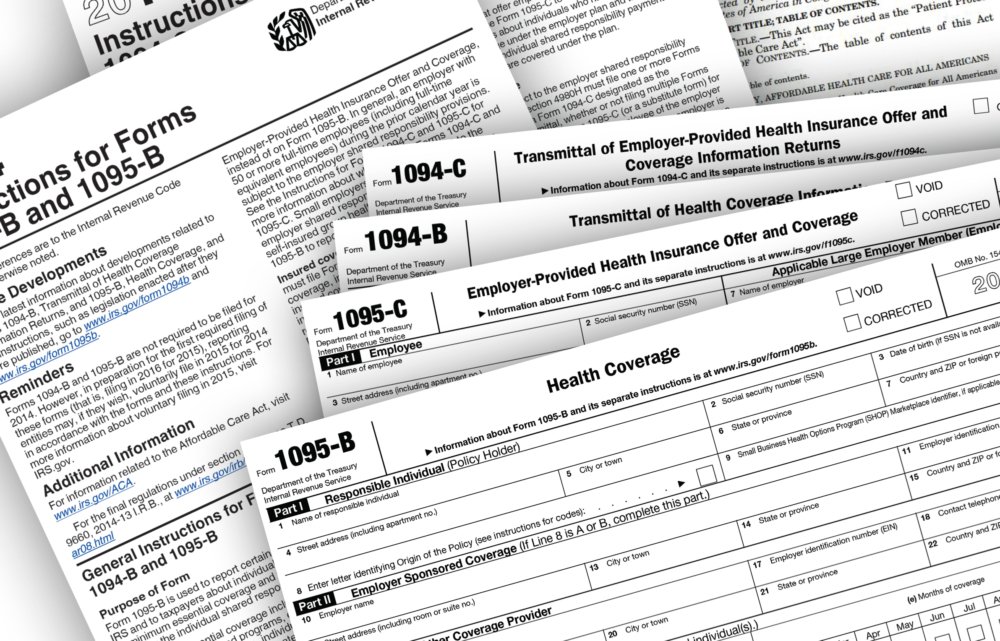

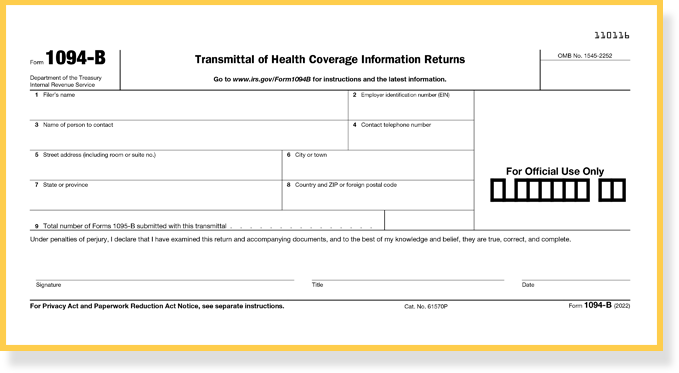

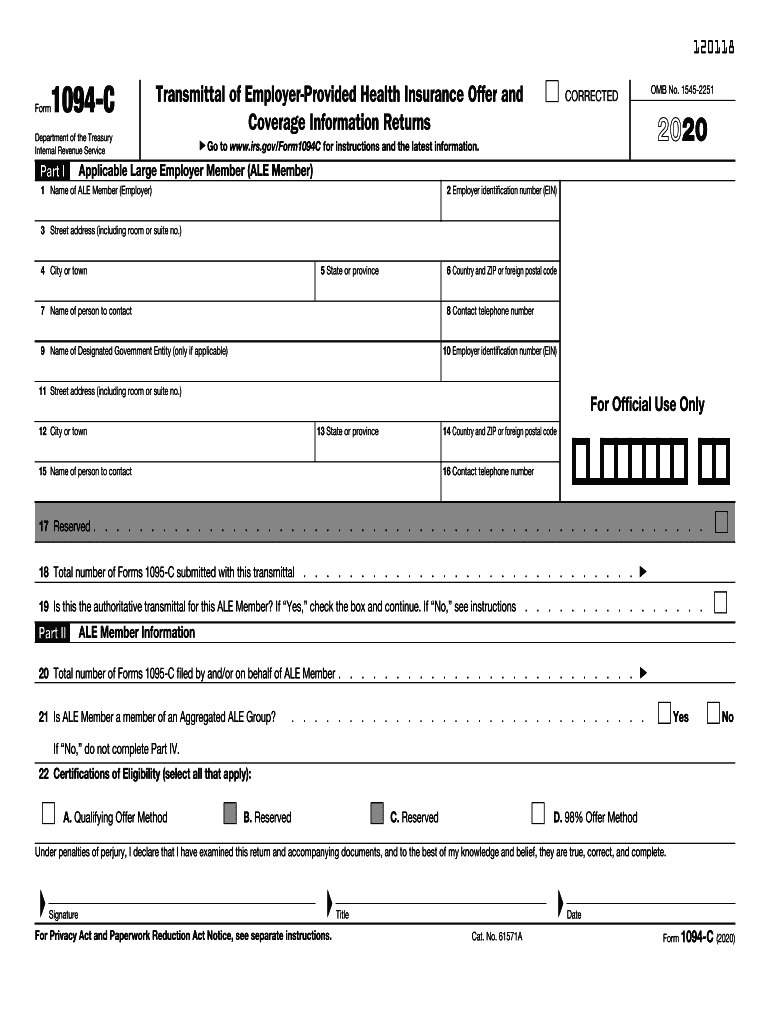

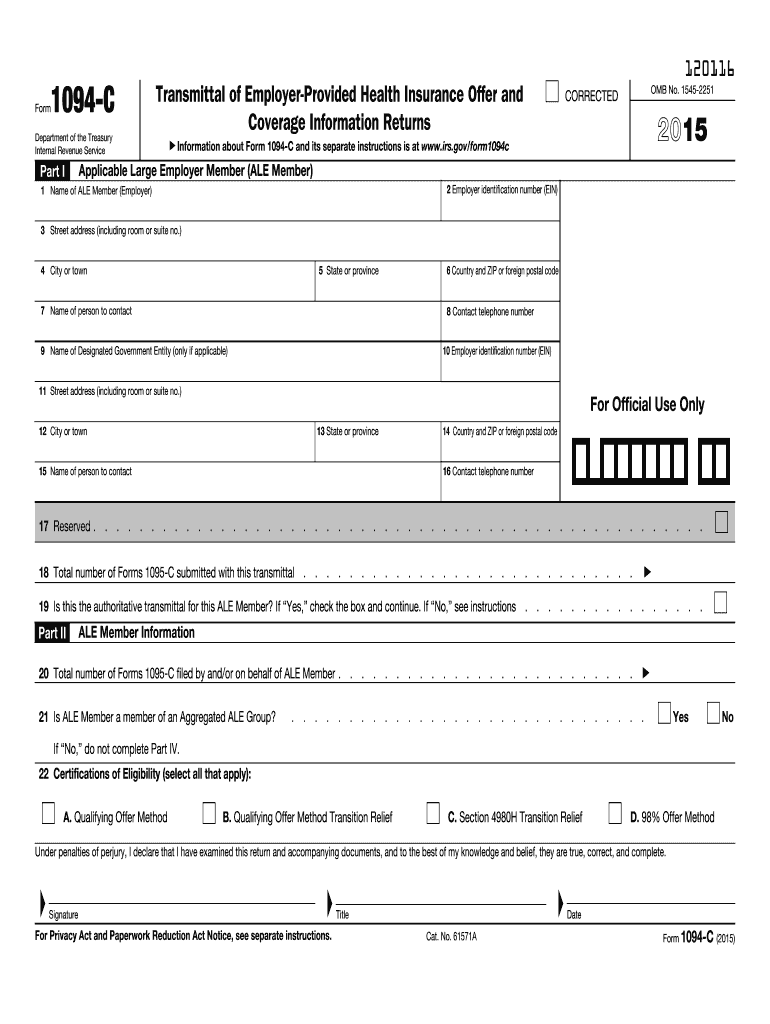

IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the 1095COne of these Forms 1094C should be identified as the Authoritative Transmittal on line 19, and should include aggregate employerlevel data for all 1,0 fulltime employees of Employer B as well as the total number of employees of Employer B, as applicable, as required in Parts II, III, and IV of Form 1094C The due date to send individuals the 19 Form 1095B or Form 1095C is now The original due date was Jan 31, However, the IRS has determined that there is no need for an extension of time for filing those forms with the IRS, or for the 19 Form 1094B, Transmittal of Health Coverage Information Returns, and Form 1094C

Streamlined Aca Reporting Methods Newfront Insurance And Financial Services

1094 c form 2019

1094 c form 2019-Back to 1094C Form Guide ;1095c due date 1921 Complete forms electronically working with PDF or Word format Make them reusable by making templates, include and complete fillable fields Approve documents by using a lawful electronic signature and share them via email, fax or print them out download documents on your personal computer or mobile device Boost your efficiency with effective

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

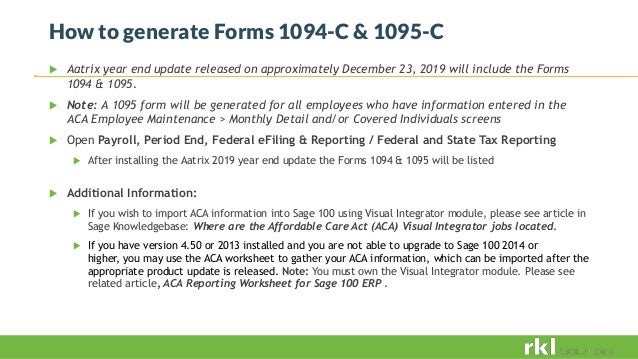

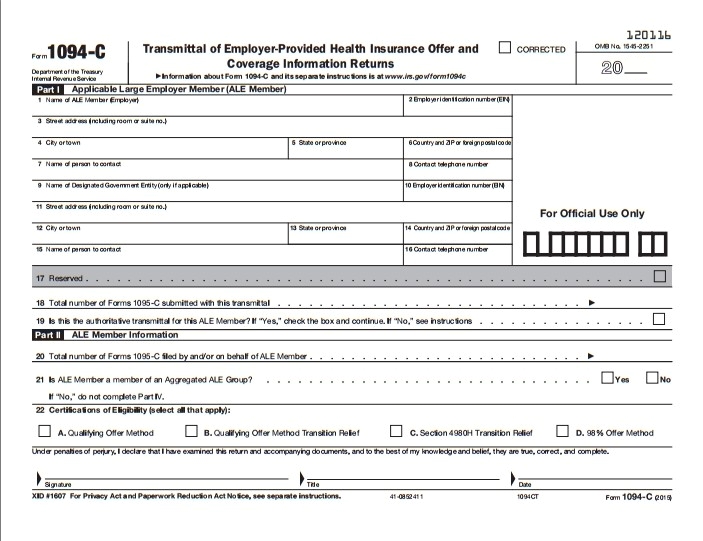

If you check Box C, you must also complete Part III, column (e) of Form 1094C, Section 4980H Transition Relief Indicator D 98% Offer Method Check this box if you're eligible for and using the 98% Offer Method In order to check this, you must have offered affordable health coverage to at least 98% of your fulltime employees during their Forms 1094C and 1095C filing date extended to Monday, The Internal Revenue Service has extended the due date for furnishing forms under Section 6055 and 6056 for 18 from Jan 31, 19 to No request or other documentation is required to take advantage of the extended deadlineIRS Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Form 1094C is used by Applicable Large Employers (ALEs), or employers that had 50 or more fulltime employees during the calendar year ALEs must file Form 1095C for each of their employees to disclose information about the healthcare coverage and enrollment offered

IRS Issues Draft 19 ACA Forms 1094C and 1095C and Reporting Instructions Joanna KimBrunetti The IRS has released draft versions of Forms 1094C and 1095C, as well as the reporting instructions for the 19 tax year, to be filed and furnished inForms 1094C and 1095C report health care coverage information to the IRS Employers must distribute copies of Form 1095C to fulltime employees If you have less than 50 fulltime employees (including f/t equivalents) you do not have to file these IRS forms The IRS released the draft instructions to the Forms 1094C and 1095C on While many, including us as discussed in our previous article, expected some changes as a result of the Individual Mandate being reduced to $0 beginning in 19, the draft instructions were virtually identical compared to the 18 iteration of the instructions The

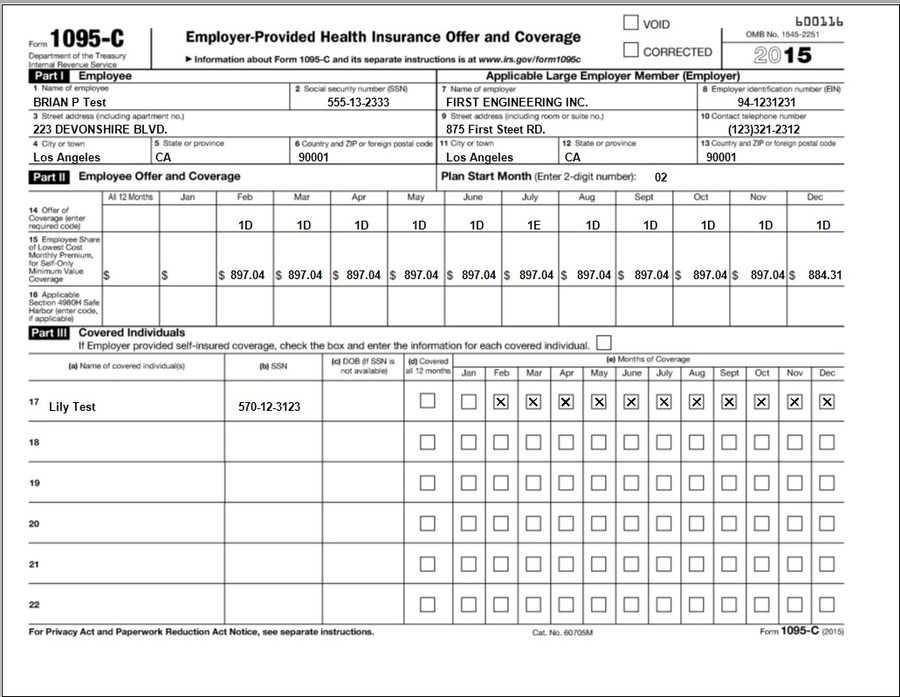

The 1094C and 1095C filings used by Applicable Large Employers along with employee tax returns will be used by the IRS to determine if the employer owes a shared responsibility payment and whether employees are/were eligible for a premium subsidy Any penalties will be calculated and communicated by the IRS in Letter 226J Employers owe the IRS a1094c 1921 Complete blanks electronically using PDF or Word format Make them reusable by making templates, include and complete fillable fields Approve documents using a lawful electronic signature and share them via email, fax or print them out Save forms on your laptop or mobile device Improve your productivity with powerful solution? Updated For Administrators and Employees For the filing year, Applicable Large Employers ( ALEs) must provide Forms 1095C to employees by ALEs must submit Forms 1095C, along with Form 1094C, to the IRS by (if filed by mail) or (if filed electronically)

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

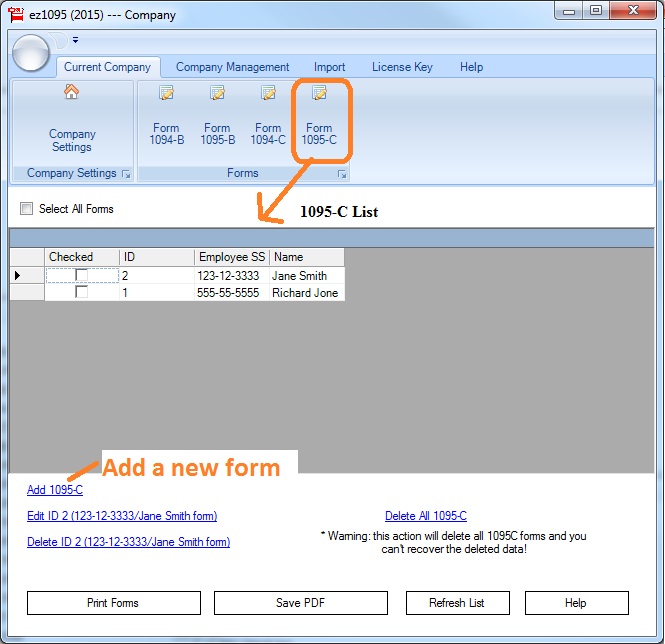

Newest Ez1095 Aca Software Is Easy And Fast With Latest Import Feature In The 19 Version

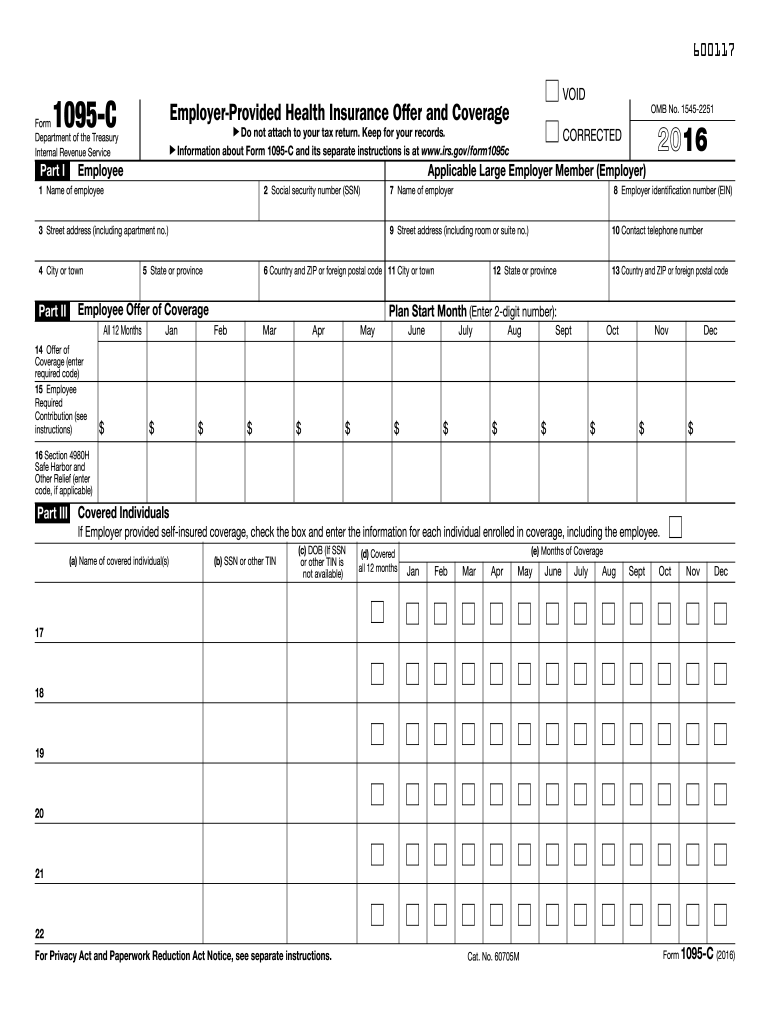

C Form Instructions The IRS has finalized Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 18 tax year As a reminder, the B Forms are filed by minimum essential coverage providers (mostly insurers and governmentsponsored programs, but also some selfinsuring employers and others) to report Each FullTime employee must be provided an IRS Form 1095C by IRS Form 1094C, along with all FullTime employees' Form 1095Cs, must be transmitted to the IRS by March 31 every year (April 1 in 19), if an employer files these Forms electronically Employers who issue less than 250 1095C information returns may file paper copies of the Forms,Fill Online, Printable, Fillable, Blank F1094c 19 Form 1094C Form Use Fill to complete blank online IRS pdf forms for free Once completed you can sign your fillable form or send for signing All forms are printable and downloadable F1094c 19 Form 1094C On average this form takes 35 minutes to complete

2

Common Mistakes In Completing Forms 1094 C And 1095 C

1094C and 1095C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their employees Form 1094C must be used to report to the IRS summary information for each ALE Member (defined below) and to transmit Forms 1095C to the IRS Form 1094C Prepare a new authoritative Form 1094C (only one needs to be filled out, this Form reports aggregate employerlevel data for all fulltime employees) Complete a fully completed Form 1094C and denote a "X" in the "CORRECTED" box on the top of the form;19 ACA 1094/1095 Deadlines Chart Due Dates in 19 Action Fully Insured ALEs SelfInsured ALEs SelfInsured Employers That are not ALEs (Fewer Than 50 FullTime Employees) Provide Form 1095C to FullTime Employees January 31 January 31 Not Applicable Provide Form 1095B to Responsible Individuals (may be the primary insured, employee,

Www Irs Gov Pub Irs Prior Ib 19 Pdf

16 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Draft C Form Instructions The IRS has released draft Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 19 tax year As a reminder, the B Forms are filed by minimum essential coverage providers (mostly insurers and governmentsponsored programs, but also some selfinsuring employers and others) to report coverage The IRS issued final versions for four ACA forms, including Forms 1094B, 1095B, 1094C, and 1095C The forms can be accessed using the following links Form 1094B Form 1095B Form 1094C Form 1095C The IRS also released full instructions for Forms 1094C and 1095C for employers and HR teams, as well as instructions for Forms 1094Information about Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, including recent updates, related forms, and instructions on how to file Form 1094C is the transmittal form that must be filed with the Form 1095C

1095 C Print Mail s

Irs Releases Draft 19 Forms 1094 And 1095 And Related Instructions

Form 1095C EmployerProvided Health Insurance Offer and Coverage 21 Form 1095B Health Coverage 21 Inst 1094B and 1095B Instructions for Forms 1094B and 1095B Inst 1094C and 1095C Instructions for Forms 1094C and 1095CApplicable large employers with 50 or more fulltime or fulltimeequivalent employees use efileACAforms to save on the labor costs of preparing, printing, mailing and manually submitting their 1095C and 1094C forms to the IRS Smaller, selfinsured employers who must fill out the 1095B and 1094B transmittal form use efileACAforms to report the names, addresses and The due date for furnishing 19 Form 1095C is extended from Jan 31, , to Goodfaith transition relief from penalties under sections 6721 and 6722 for incorrect or incomplete information reporting on the returns is extended to the 19 tax filing year

Irs Announces Limited Relief For Information Reporting On Forms 1094 1095

Irs Extends Deadline For Furnishing Form 1095 C Extends Good Faith Transition Relief Fedeli Group

Form 1094C gets auto generated based on the 1095C forms input inside the system This saves users time and simplifies the filing process As an employer you can think of the 1095C as the W2 form of ACA healthcare reporting and 1094C as the W3 transmittal of ACA reporting And the due dates are also similarForm 1094C is essentially a cover sheet for 1095C and is only sent to the IRS The Role of the 1095C The Affordable Care Act requires employers with at least 50 fulltime employees to provide health insurance to their employeesForm 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Return Filing is optional for CY 14, but required for Coverage Years starting in 15 All Applicable Large Employer (ALE) Members are required to file Forms 1094C and 1095C for Coverage Years starting in 16

Upcoming Key Compliance Deadlines And Reminders For First Quarter Lockton Companies

/1095b-741f9631132347ab8f1d83647278c783.jpg)

Form 1095 B Health Coverage Definition

Submit the standalone corrective Form 1094CForm 1094C Department of the Treasury Internal Revenue Service Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Go to wwwirsgov/Form1094C for instructions and the latest information OMB No 19 Part I Applicable Large Employer Member (ALE Member) 1 Name of ALE Member (Employer) 2Form 1094C is the transmittal form that accompanies Form 1095C when filing with the IRS each year Together, Forms 1094C and 1095C are used to provide information to the IRS regarding health insurance coverage offered to your fulltime employees and that status of individual employee's enrollment Form 1094C is only sent to the IRS, not to employees

The 19 Aca Reporting Is Due In Early Final Forms And Instructions Released Narfa

Www Irs Gov Pub Irs Utl Instructions for ty18 predefined aats scenarios Pdf

Employers subject to section 4980H of the Internal Revenue Code ("Code"), generally meaning Employers or other coverage providers that do not comply with the due dates for furnishing Forms 1095B and 1095C (as extended under the rules described above) or for filing Forms 1094B, 1095B, 1094C, or 1095C are subject to penalties under section 6722 or 6721 for failure to timely furnish and file, respectivelyAlthough form 1095C must be sent both to the IRS and all fulltime employees (whether they participate in the employeroffered plan or not), form 1094C goes to the IRS only and not employees As for the filing deadlines, for the first year, the IRS announced an automatic extension in the due dates for forms 1094C and 1095C The 1095C forms

What You Need To Know About Forms 1094 1095

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

After a lengthy and unexplained delay, the Internal Revenue Service released drafts of the 19 Forms 1094C, 1095C and their corresponding instructions on The forms and reporting obligations are basically unchanged from 18 There had been speculation that reporting might be streamlined due to the repealA corrected Form 1095C must be sent along with a 1094C transmittal form Be sure to only check the "corrected" box on the Form 1095C, not 1094C A copy of the corrected form must also be furnished to the employee Again, refer to the C Form Instructions The IRS has released final Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 19 tax year No material changes have been made to the forms, either from prior years or from the drafts released in November (see our Checkpoint article ) (The "Instructions for Recipient" included with Form

Irs 1094 C Form Pdffiller

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Form 1094C Department of the Treasury Internal Revenue Service Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Go to wwwirsgov/Form1094C for instructions and the latest information OMB No Part I Applicable Large Employer Member (ALE Member) 1 Name of ALE Member (Employer) 226 rows Form 1094C Transmittal of EmployerProvided Health Insurance Offer and CoveragePart III ALE Member Information Monthly Line 23 to Line 25 ALE Member Information Reminder Part III (Lines 2335) should only be completed on the Authoritative Transmittal for the employer In Column (a), if you offered Minimum Essential Covertage (MEC) to at least 95% of your fulltime employees and their dependents, enter "X" in

1

Upcoming Key Compliance Deadlines And Reminders For First Quarter Lockton Companies

Employers must also complete form 1094C, which acts as a summary for the aggregated 1095C forms and provides helpful information to the IRS, including contact information and the employer's Employer Identification Number (EIN), the name of a contact person, and the total number of employees Preparing for ACA yearend reportingStep 5 Print Tax Form 1094C Click the top menu "Current Company" then the sub menu "Form 1094C" to view 1094C screen Note ez1095 software can print both 1095C and 1094 C forms for IRS and recipients on white paper No preprinted form is needed IRS changed form format in Year The Form has 2 pages Year 1519 form has only one page Form 1094C (19) DO NOT FILE DRAFT AS OF 1316 Form 1094C (19) Page 3 Part IV Other ALE Members of Aggregated ALE Group Enter the names and EINs of Other ALE Members of the Aggregated ALE Group (who were members at any time during the calendar year)

Form 1095 A 1095 B 1095 C And Instructions

Aca Reporting Generate Review Your 1094c 1095c Data And Forms

The 1094C form is not considered a correction by the IRS if it is being submitted as the cover page for one or more corrected 1095C forms The accompanying 1094C form is simply a new form and the data on it should reflect what is being submitted with it (eg, if 1 form needs correcting, Line 18 on the 1094 form will state "1" even The IRS has released draft versions of Forms 1094C and 1095C, as well as the reporting instructions for the 19 tax year, to be filed and furnished in You can find the draft 19 filing instructions by clicking here The draft 19 versions of Form 1094C and 1095C are also available for download at the following links

What You Need To Know About 1094 Forms Blog Taxbandits

Irs Releases Forms 1094 1095 And Related Instructions Including New Rules For Ichra Reporting

2

Irs Releases Forms 1094 1095 And Instructions For Early 19 Aca Reporting

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

2

Sage 100cloud Year End Processing And Payroll Webinar 19

Irs Form 1094 C Form 1094 C Online 1095 C Transmittal Form

Yes Employers Still Need To File Forms 1094 And 1095 Word On Benefits

Streamlined Aca Reporting Methods Newfront Insurance And Financial Services

1

Www Scu Edu Media Offices Human Resources Documents Benefits 1094 C 1095 C Forms Guidance Pdf

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

21 Aca Compliance Checklist For Employers Integrity Data

Affordable Care Act Aca Ability To Generate 1095 B And 1095 C Forms Microsoft Dynamics Ax Community

2

1095 1094 Aca Forms Ez1095 19 From Halfpricesoft Com Just Released Efile Version

2

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

2

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Will You Be Ready To Report Aca Gps

Form 1095 C Guide For Employees Contact Us

Employers With 50 99 Ftes Cy15 Aca Returns A Must For Irs Integrity Data

Your 1095 C Obligations Explained

Irs Issuing 1094 C 1095 C Penalties Essential Staffcare

Filing Form 1094 C Youtube

Ez1095 Software How To Print Form 1095 C And 1094 C

Form 1094 C The Aca Times

Irs Releases 1094 C 1095 C Forms For 19 Tax Year

Aca Compliance Filing Deadlines For The 18 Tax Year

1094 C Form Transmittal Discount Tax Forms

Q Tbn And9gctm28mgrcxacjysuiweiug6urts6i0vauaci8une7eonfp6ttdc Usqp Cau

It S Year End Time Again Are You Gp Payroll Ready Erp Software Blog

Code Series 2 For Form 1095 C Line 16

Overview Of 1095c Form

3

Irs Issues Draft 19 Aca Forms 1094 C And 1095 C And Reporting Instructions The Aca Times

Get To Know Aca Forms 1094 C And 1095 C The Aca Times

Newest Ez1095 Aca Software Is Easy And Fast With Latest Import Feature In The 19 Version

2

2

2

2

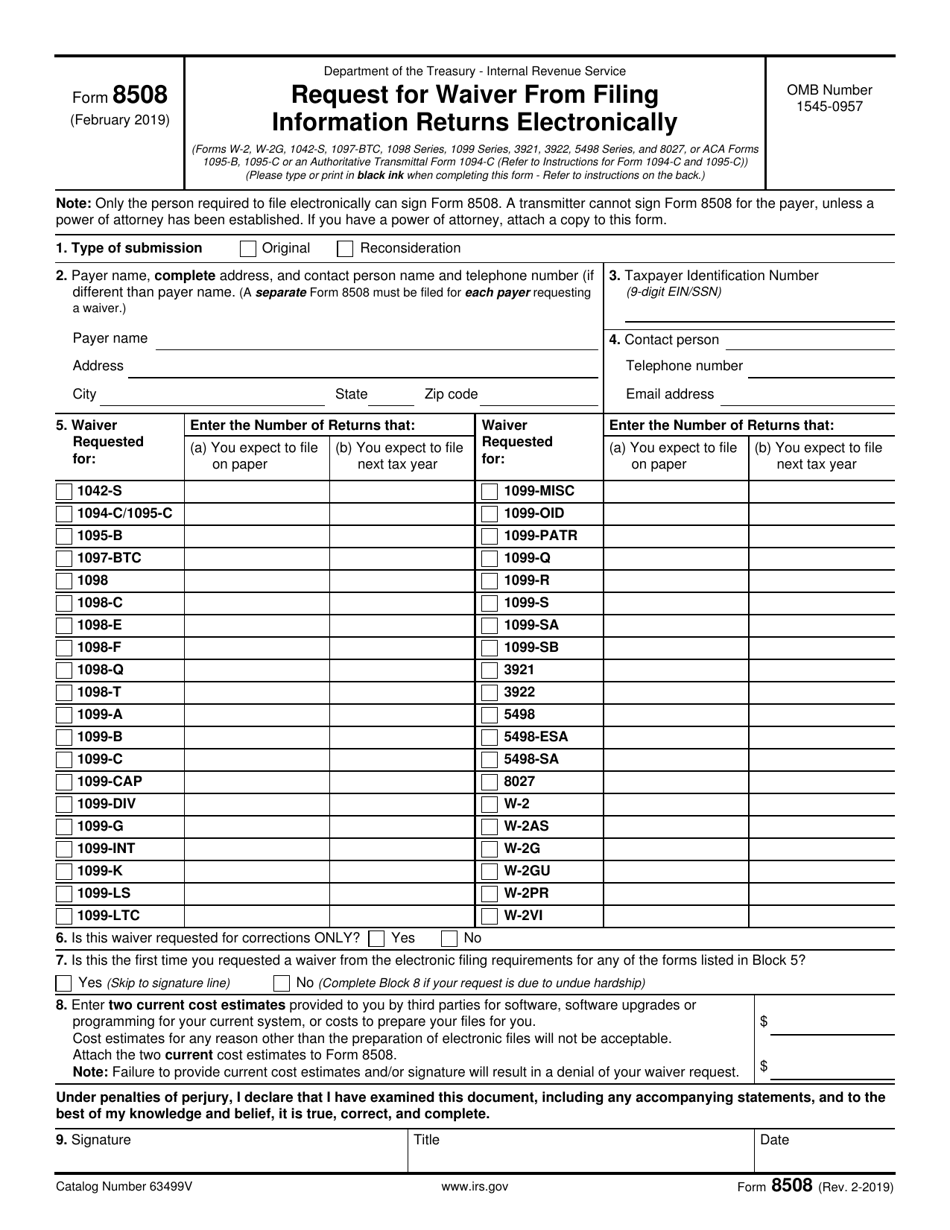

Irs Form 8508 Download Fillable Pdf Or Fill Online Request For Waiver From Filing Information Returns Electronically Templateroller

Ez1095 Software How To Print Form 1095 C And 1094 C

Your 1095 C Obligations Explained

Filing Aca Form 1094 C Youtube

Procedures To Print The 1094 C And Mail The 1094 C And 1095 C S To The Irs Integrity Data

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

Form 1094 C Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns All Pages B1094cs05 21 41 25

Irs Releases Forms 1094 1095 And Instructions For Early 19 Aca Reporting

Irs 1095 C Form Pdffiller

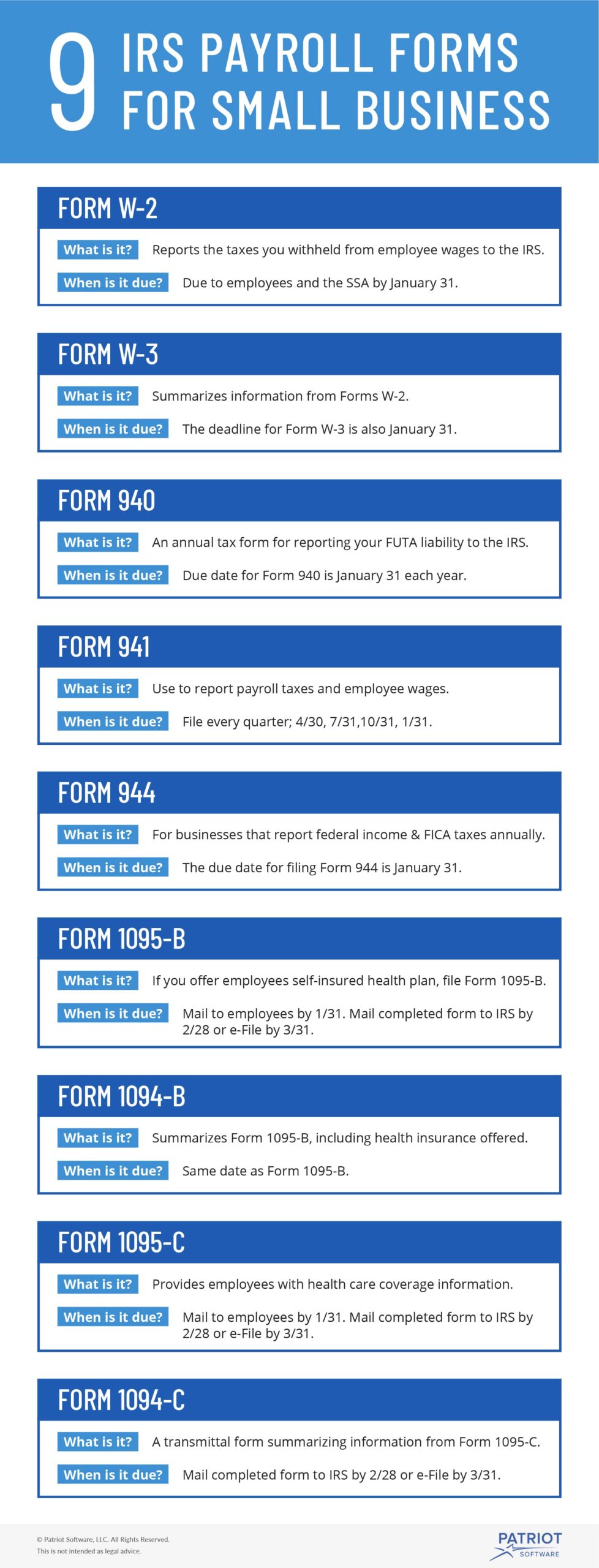

9 Irs Payroll Forms For Small Businesses To Know About

E File Form 1099 Misc Online Irs Forms Efile Filing Taxes

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Your 1095 C Obligations Explained

Www Scu Edu Media Offices Human Resources Documents Benefits 1094 C 1095 C Forms Guidance Pdf

1094 C 1095 C Software 599 1095 C Software

2

2

2

What Is The Difference Between Forms 1094 C And 1095 C Turbotax Tax Tips Videos

W 2 Laser Federal Irs Copy A

Form 1095 A 1095 B 1095 C And Instructions

Irs Release Drafts Of Irs Forms 1094 C And 1095 C The Aca Times

Yearli Form 1095 C

Irs Extends Form 1095 C Distribution Deadline Once Again Sgr Law

1094 C 1095 C Software 599 1095 C Software

Benefit Advisors Network

2

Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

Avoid Common Errors This Aca Reporting Season Health E Fx

Use Alio To Meet Federal Requirements 19

New Form 1095 C Draft Issued By Irs For Filing In 22 Bernieportal

2

Form 1095 A 1095 B 1095 C And Instructions

Irs Finally Finalizes 19 Forms 1094 And 1095 And Related Instructions

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

Thought Obamacare Was Gone Not Quite Accounting Today

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

15 Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller